simply amazing, always for you.

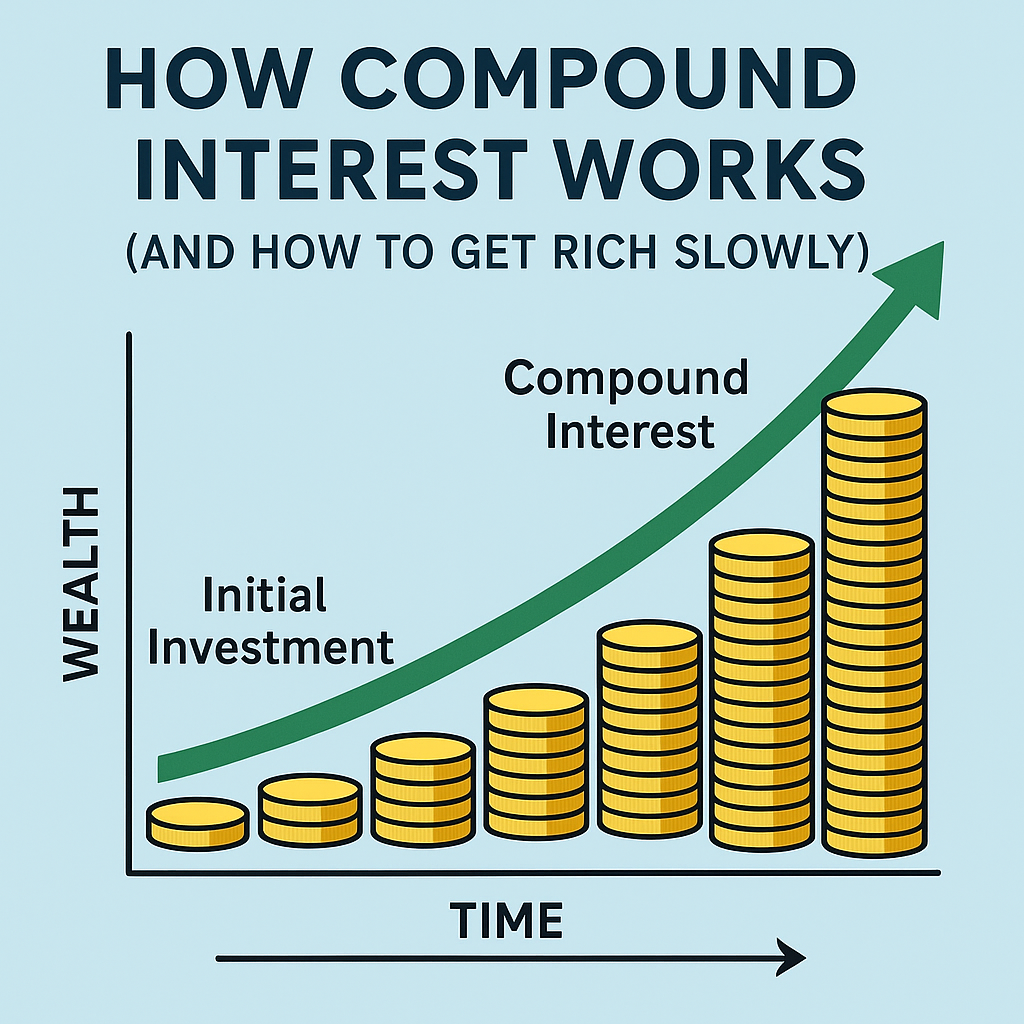

In a world obsessed with fast money and instant gratification, the humble power of compound interest remains one of the most overlooked yet transformative financial forces. Compound interest doesn’t scream for attention—it whispers in silence. But over time, it builds fortunes from modest beginnings, slowly and steadily.

In this article, you’ll learn what compound interest is, how it works, why it’s different from simple interest, and how you can use it to build wealth gradually and securely.

What Is Compound Interest?

At its core, compound interest is the process of earning interest on both your initial investment (the principal) and the accumulated interest over time. It’s money that grows on money, and then continues growing on that growth.

To visualize it, imagine planting a tree. After a few years, the tree bears fruit. Instead of eating all the fruit, you plant some of the seeds. Over time, those seeds become trees that also bear fruit, and the cycle continues. Eventually, you have an orchard—all from that one original tree.

In financial terms, compound interest means that your money grows exponentially, not just linearly.

Compound Interest vs. Simple Interest

Let’s break down the difference:

- Simple interest is calculated only on the original principal.

- Compound interest is calculated on the principal + any previously earned interest.

Let’s say you invest $1,000 at an annual interest rate of 10% for five years.

With simple interest:

You earn 10% of $1,000 each year = $100/year

Over 5 years = $500

Total = $1,500

With compound interest (compounded annually):

Year 1: $1,000 → $1,100

Year 2: $1,100 → $1,210

Year 3: $1,210 → $1,331

Year 4: $1,331 → $1,464.10

Year 5: $1,464.10 → $1,610.51

That’s an extra $110.51, just for letting your earnings stay invested.

Now imagine that happening over 20, 30, or 40 years. The results become staggering.

The Magic Formula: How to Calculate Compound Interest

The compound interest formula is: A=P×(1+rn)ntA = P \times (1 + \frac{r}{n})^{nt}A=P×(1+nr)nt

Where:

- A = Final amount

- P = Principal amount (initial deposit)

- r = Annual interest rate (decimal form)

- n = Number of times interest is compounded per year

- t = Time the money is invested for (in years)

Example:

Invest $10,000 at 8% interest, compounded annually, for 20 years. A=10,000×(1+0.081)1×20=10,000×(1.08)20=$46,610.57A = 10,000 \times (1 + \frac{0.08}{1})^{1 \times 20} = 10,000 \times (1.08)^{20} = \$46,610.57A=10,000×(1+10.08)1×20=10,000×(1.08)20=$46,610.57

You didn’t invest anything extra, yet your money grew nearly 5x. That’s the quiet power of compound interest.

The Rule of 72: Estimate How Long It Takes to Double

To estimate how long your investment will take to double, use the Rule of 72: \text{Years to Double} = \frac{72}{\text{Annual Interest Rate (%)}}

If your investment grows at 9% annually: 72/9=8 years72 / 9 = 8 \text{ years}72/9=8 years

So, a $5,000 investment could grow to $10,000 in 8 years, $20,000 in 16 years, and $40,000 in 24 years—without adding a single extra dollar.

The Real Secret: Time Is More Important Than Money

Most people think you need a lot of money to get rich. But with compound interest, starting early is more important than starting big.

Consider this:

- Alex starts investing $200/month at age 25 and stops at 35. Total invested = $24,000

- Jordan starts investing $200/month at age 35 and continues until 65. Total invested = $72,000

Assuming an average 8% annual return:

- Alex’s investment grows to over $315,000 at age 65

- Jordan’s grows to around $300,000

Even though Alex invested only one-third as much, he ends up with more money—because his investments had more time to compound.

How to Get Rich Slowly: 7 Practical Steps

1. Start Immediately, No Matter the Amount

Don’t wait to have $5,000 or $10,000 to begin investing. Even small amounts—$25, $50, $100—can turn into serious money over time.

2. Invest Regularly and Automatically

Set up automatic monthly contributions to your investment account. This builds the habit and removes the temptation to skip months.

3. Let It Ride—Reinvest Everything

Dividends, interest, capital gains—reinvest them all. Every cent you reinvest starts earning more money on your behalf.

4. Use Tax-Advantaged Accounts

In the U.S., accounts like 401(k)s, Roth IRAs, and Traditional IRAs help your investments grow tax-deferred or tax-free. That’s turbocharged compounding.

5. Avoid Interrupting the Cycle

Don’t pull money out unless absolutely necessary. Early withdrawals and market panic sales interrupt the compounding process and set you back.

6. Increase Contributions as You Earn More

Whenever you get a raise or windfall, increase your investment contributions. The more you feed the compounding machine, the faster it grows.

7. Stay in the Market

Trying to time the market is a losing game. Time in the market beats timing the market. Missing just the best 10 days in a decade can dramatically reduce your returns.

Best Investments for Compound Growth

Compound interest is not limited to savings accounts. Here’s where you’ll find the best long-term results:

1. Stock Market (Index Funds)

Low-cost index funds like S&P 500 ETFs have historically returned 7–10% annually.

2. Dividend Reinvestment Plans (DRIPs)

Automatically reinvest dividends to grow your stockholdings.

3. Real Estate

Property values appreciate, and rent payments can be reinvested. While not technically “interest,” the compounding effect works similarly.

4. Robo-Advisors

Automated investment platforms make it easy for beginners to invest regularly with minimal fees.

5. High-Yield Savings and CDs

Good for short-term or emergency funds, though the growth is slower due to lower returns.

A Word of Caution: Inflation and Taxes

Compound interest is powerful, but inflation and taxes can eat into your returns.

- Inflation reduces your purchasing power. Aim for investments that outpace inflation.

- Taxes on capital gains and interest can reduce compounding efficiency. Use tax-advantaged accounts where possible.

Why Most People Miss Out on Compounding

Despite its simplicity, many people fail to take full advantage of compound interest. Here’s why:

1. Lack of Patience

We’re wired to want quick wins. Compound interest is slow at first but accelerates later. Most people give up too soon.

2. Not Investing at All

Some people keep their savings in low-interest accounts or worse, under a mattress, missing out on potential growth.

3. Too Much Lifestyle Spending

Instead of investing extra income, many increase their lifestyle. Cars, gadgets, clothes—these lose value. Invest in appreciating assets instead.

4. Fear of the Market

Yes, markets fluctuate. But historically, they rise over time. With a long-term view, downturns become buying opportunities.

Compound Interest in Real Life: The Story of Grace Groner

Grace Groner was a secretary who worked for Abbott Laboratories. She lived simply and invested $180 in Abbott stock in 1935. She held it for decades, reinvesting all dividends.

When she died in 2010, her estate was worth over $7 million—and she donated it all to charity.

She didn’t win the lottery. She didn’t start a tech company. She just understood compound interest and let time do the work.

Get Rich Slowly, Stay Rich Forever

Getting rich slowly isn’t flashy. It doesn’t go viral on social media. But it works. The wealthy understand that the real key to building wealth isn’t gambling on quick wins—it’s embracing compound interest and giving it time to work its magic.

Start small. Stay consistent. Reinvest relentlessly. Protect your investments. And be patient.

Because in the end, the person who understands and uses compound interest—not the person chasing hot stocks or get-rich schemes—is the one who reaches true financial independence.

Support Our Website!

We appreciate your visit and hope you find our content valuable. If you’d like to support us further, please consider contributing through the TILL NUMBER: 9549825. Your support helps us keep delivering great content!

If you’d like to support Nabado from outside Kenya, we invite you to send your contributions through trusted third-party services such as Remitly, SendWave, or WorldRemit. These platforms are reliable and convenient for international money transfers.

Please use the following details when sending your support:

Phone Number: +254701838999

Recipient Name: Peterson Getuma Okemwa

We sincerely appreciate your generosity and support. Thank you for being part of this journey!