simply amazing, always for you.

Let’s be honest: the word “budget” doesn’t exactly scream excitement. In fact, for most people, budgeting feels like a boring chore, a financial diet that restricts all the fun stuff. But what if I told you that a personal budget could actually give you more freedom, not less?

A well-crafted budget isn’t about cutting every indulgence or tracking every penny obsessively. It’s about understanding your money, knowing where it goes, and using it to build a life that aligns with your values and goals. Whether you’re trying to break free from the paycheck-to-paycheck cycle, pay off debt, or finally save for that dream vacation, a budget is your game plan—and yes, it can actually work if you do it right.

In this article, we’ll walk through a step-by-step guide to creating a personal budget that actually sticks. One that feels empowering, not suffocating. Let’s dive in.

Why Most Budgets Fail (and How to Avoid It)

Before we break down the how-to, let’s address the elephant in the room: most budgets fail because they’re too rigid, too unrealistic, or just not designed to fit your life.

Here’s why many people give up on their budgets:

- They don’t track actual spending habits

- They set goals that aren’t achievable

- They forget about irregular expenses

- They don’t leave room for fun

- They treat the budget like a punishment, not a tool

The solution? You need a budget that’s flexible, honest, and personalized. You want a system that adapts to your lifestyle, not one that demands a total lifestyle overhaul.

Step 1: Know Why You’re Budgeting

This might sound cliché, but understanding your “why” is crucial. A budget without a purpose is just a spreadsheet with numbers. Your motivation gives the budget meaning.

Ask yourself:

- Are you trying to pay off debt?

- Save for a home, vacation, or emergency fund?

- Stop the anxiety of living paycheck to paycheck?

- Gain control over your financial future?

Write it down. Put it somewhere you’ll see it often. Your “why” will keep you going when temptation strikes or motivation dips.

Step 2: Calculate Your Net Monthly Income

You can’t build a realistic budget unless you know exactly how much money is coming in.

Here’s what counts:

- Your salary (after taxes and deductions)

- Side hustles or freelance gigs

- Rental income

- Government benefits (if applicable)

- Alimony or child support

Tip: Focus on net income, not gross. That’s the amount that actually lands in your bank account each month.

If your income fluctuates, take an average of the last 3–6 months to build your baseline.

Step 3: Track Your Current Spending Habits

This is where most people skip ahead—and then wonder why their budget doesn’t work.

Spend a few weeks or go back through your last 2–3 months of bank and credit card statements to answer this essential question: Where is my money actually going?

Break down expenses into two main categories:

Fixed Expenses (same every month):

- Rent or mortgage

- Utilities

- Phone bill

- Insurance

- Subscriptions (Netflix, Spotify, etc.)

- Debt payments

Variable Expenses (change month to month):

- Groceries

- Gas/transport

- Dining out

- Entertainment

- Shopping

- Coffee (yes, even the $5 lattes count)

Be brutally honest. This isn’t about guilt—it’s about awareness.

Step 4: Choose a Budgeting Method That Fits You

There’s no one-size-fits-all budgeting style. The best method is the one you’ll actually stick with.

Here are four popular budgeting methods:

1. The 50/30/20 Rule

- 50% Needs: Housing, bills, food, transport

- 30% Wants: Entertainment, travel, shopping

- 20% Savings and Debt Repayment

Great for people who want a simple framework without too much micro-tracking.

2. Zero-Based Budgeting

Every dollar gets assigned a job. Income – Expenses = $0

You allocate every single dollar to a category—even if it’s “fun money” or “savings.”

Ideal for people who want full control.

3. The Envelope System

Divide your cash into envelopes (digital or physical) for each spending category. Once the envelope is empty, no more spending in that category for the month.

Best for folks who overspend or need visual limits.

4. Pay Yourself First

Automatically save a set portion (e.g., 20%) of your income before you do anything else. Then live off the rest.

Perfect for people who struggle to save consistently.

Step 5: Set Realistic Financial Goals

A budget should move you toward a better future.

Set short-term (1–12 months), mid-term (1–5 years), and long-term (5+ years) goals.

Examples:

- Build a $1,000 emergency fund in 3 months

- Pay off a $5,000 credit card balance this year

- Save $20,000 for a house down payment in 3 years

- Invest 15% of your income for retirement

SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) work best. Don’t just say “I want to save money.” Say “I want to save $500 in 3 months by cooking at home instead of eating out.”

Step 6: Build Your Budget Categories

Now that you’ve chosen a method and set goals, create budget categories that reflect your life.

Essential Spending:

- Rent/mortgage

- Utilities

- Groceries

- Transportation

- Insurance

- Debt payments

Non-Essential Spending:

- Dining out

- Entertainment

- Subscriptions

- Hobbies

- Travel

- Shopping

Financial Priorities:

- Emergency fund

- Retirement

- Investments

- Sinking funds (for holidays, car repairs, etc.)

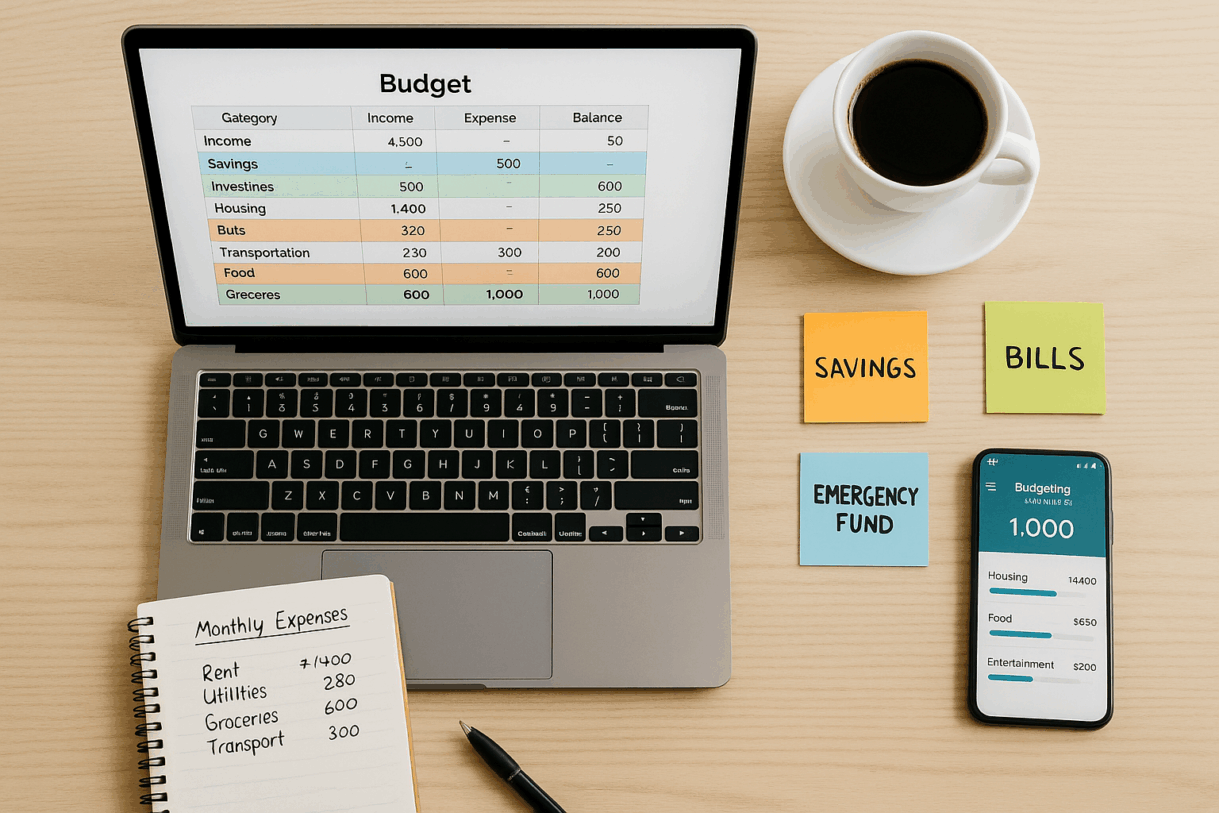

Use budgeting apps (like YNAB, Mint, or EveryDollar) or a simple spreadsheet to keep track.

Step 7: Don’t Forget Irregular Expenses

Most budgets fail because people forget about those sneaky, occasional costs:

- Birthdays

- Holidays

- Car repairs

- Back-to-school shopping

- Annual insurance premiums

Solution? Sinking funds. Set aside a little each month for these future expenses so they don’t blow up your budget later.

Example: If Christmas costs you $600, set aside $50 a month starting in January.

Step 8: Use Budgeting Tools and Apps

If spreadsheets bore you or you lose track easily, lean on technology.

Best Budgeting Apps in 2025:

- YNAB (You Need A Budget) – Ideal for zero-based budgeting lovers

- Mint – Free, automated, and user-friendly

- GoodBudget – Great for envelope budgeting

- PocketGuard – Shows you how much is “safe to spend”

- Monarch Money – Trendy new app with collaborative tools for couples

Many banks now also offer built-in budgeting tools in their mobile apps. Explore your options and pick one that you’ll actually enjoy using.

Step 9: Automate What You Can

Budgeting shouldn’t feel like a full-time job. Automate these to make life easier:

- Savings: Set up automatic transfers to savings accounts each payday

- Bill payments: Schedule recurring payments for rent, loans, and utilities

- Investments: Automate contributions to your 401(k), Roth IRA, or brokerage account

When automation does the heavy lifting, it reduces your chances of forgetting, procrastinating, or spending the money elsewhere.

Step 10: Track and Adjust Weekly

Think of your budget as a living document—not something you set once and never touch again.

Every week:

- Review transactions

- Categorize expenses

- Adjust for any surprises

- Check progress toward goals

At the end of each month:

- See what worked

- Identify where you overspent

- Tweak your budget accordingly

This consistent review habit is the difference between a budget that works and one that gathers digital dust.

Example of a Realistic Monthly Budget (Net Income: $4,000)

| Category | Budget |

|---|---|

| Rent | $1,200 |

| Utilities | $150 |

| Groceries | $400 |

| Transportation | $200 |

| Insurance | $150 |

| Debt Payments | $400 |

| Emergency Fund | $300 |

| Retirement Savings | $200 |

| Dining Out | $150 |

| Entertainment | $100 |

| Subscriptions | $50 |

| Miscellaneous | $100 |

| Sinking Funds | $200 |

| Total | $3,600 |

| Buffer/Extra | $400 |

That buffer gives you breathing room or can be added to savings/debt payments.

What to Do When You Overspend

It will happen. Life is unpredictable.

Instead of beating yourself up:

- Review why it happened: Was it an emergency or lack of planning?

- Reallocate: Pull from other categories or your buffer

- Learn and adjust: Add a new sinking fund or increase a category limit

Remember: Overspending isn’t failure—it’s feedback.

Signs Your Budget is Actually Working

- You’re saving more without feeling deprived

- You’re more aware of your spending habits

- You feel less stressed around payday

- You’re making progress toward your goals

- You no longer panic when the car breaks down

Budgeting is about progress, not perfection.

Make Your Budget Fun (Seriously)

Yes, budgeting can be fun if you shift your mindset.

- Use colorful charts and graphs

- Reward yourself when you hit goals (budgeted, of course)

- Turn budgeting night into a ritual (wine, music, vibe)

- Involve your partner or kids and make it a team effort

The more enjoyable and meaningful you make it, the more likely you’ll stick with it.

Your Budget, Your Rules

Forget what influencers or financial gurus say you should do. Your budget should reflect your goals, your priorities, and your lifestyle.

It’s okay to spend money on things that bring you joy—as long as you’ve planned for them. A good budget is about intentionality, not restriction.

So go ahead—build a budget that supports your dreams, protects your peace, and lets you live life on your own terms.

Support Our Website!

We appreciate your visit and hope you find our content valuable. If you’d like to support us further, please consider contributing through the TILL NUMBER: 9549825. Your support helps us keep delivering great content!

If you’d like to support Nabado from outside Kenya, we invite you to send your contributions through trusted third-party services such as Remitly, SendWave, or WorldRemit. These platforms are reliable and convenient for international money transfers.

Please use the following details when sending your support:

Phone Number: +254701838999

Recipient Name: Peterson Getuma Okemwa

We sincerely appreciate your generosity and support. Thank you for being part of this journey!