simply amazing, always for you,

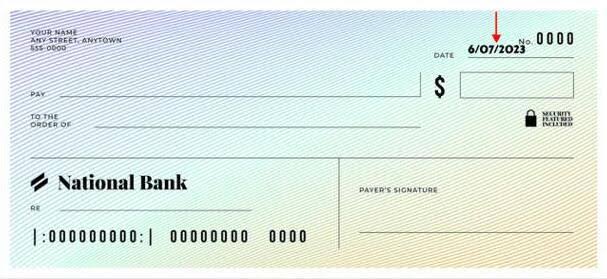

When you deposit a cheque, it’s not instantly available for withdrawal. The process of “maturation” or clearance involves several steps, and the time it takes for a cheque to mature depends on various factors such as the type of cheque, the issuing bank, the recipient bank, and the location. In this context, “maturation” refers to the time it takes for a cheque to clear and the funds to become accessible in the account.

What is Cheque Clearing?

Cheque clearing is the process through which the issuing bank transfers the funds from the drawer’s (the person writing the cheque) account to the payee’s (the person receiving the cheque) account. This involves various intermediaries and steps, including the clearinghouse (a financial institution that processes and settles cheques), which acts as a bridge between the two banks.

The process can take anywhere from a few hours to several days depending on a number of variables. In most cases, banks set a timeframe during which you cannot withdraw the cheque’s amount immediately after deposit. Once the cheque clears, it is considered “mature,” and you can access the funds.

Factors Influencing Cheque Maturation Time

- Type of Cheque The time it takes for a cheque to mature largely depends on the type of cheque being processed. Below are the most common types of cheques and their typical clearance times:

- Personal Cheques: These are the most common and are usually drawn against an individual’s bank account. When you deposit a personal cheque, the clearing process can take between 2 to 5 business days. However, if the cheque is drawn from a bank located in another city, this time may extend up to 7 to 10 days.

- Certified Cheques: A certified cheque is one that the issuing bank has verified that the drawer has enough funds to cover the cheque. These cheques usually clear much faster than personal cheques, often within 1 to 2 business days, as the bank has already verified the funds.

- Bank Drafts: A bank draft is a guaranteed payment from a bank and is typically considered a safer option than personal cheques. Due to the bank’s involvement in issuing the draft, it generally clears faster, often within 1 to 2 business days.

- Traveller’s Cheques: These are pre-printed cheques issued by financial institutions for travel purposes. They may take a few days to clear, but this depends on the specific institution.

- Location of the Cheque’s Origin The location of the cheque’s origin plays a significant role in determining the time it takes for it to mature. Local cheques, which are issued and deposited within the same geographical region or country, tend to clear faster, while outstation cheques (those from other cities or countries) generally take longer to process.

- Local Cheques: If both the drawer and the payee are from the same region or city, the cheque may take 2 to 3 business days to clear.

- Outstation or Cross-border Cheques: If the cheque is issued in a different city or country, the time frame may extend to 5 to 15 business days depending on the complexity of the transfer and international banking networks. For example, in the case of international cheques, conversion of currency and other international banking protocols may add several days to the maturation time.

- Cheque Deposit Method How you deposit the cheque can also influence the clearance time. For instance:

- In-person Deposit: If you physically visit your bank branch and deposit the cheque, the process might be quicker, and you may be able to access some portion of the funds faster, depending on your bank’s policies.

- Mobile or ATM Deposit: Many banks allow you to deposit cheques through their mobile banking app or ATM. While this is convenient, it can sometimes lead to delays, as the cheque still has to go through the same clearing process. This could add an extra 1 to 2 business days to the maturation time.

- Bank Policies and Technology Different banks may have their own internal policies for cheque clearance. Some banks have adopted digital cheque clearing systems, which can significantly speed up the process. These systems allow cheques to be scanned and processed electronically, reducing the clearing time from several days to a few hours.On the other hand, traditional cheque processing can take longer, particularly if a manual process is involved. Additionally, if there are any discrepancies or issues with the cheque (such as signature mismatch or insufficient funds in the drawer’s account), the cheque may be delayed or returned.

- Weekends and Holidays The timing of your deposit is important. If you deposit a cheque late in the day on a Friday or on a public holiday, the clearance process will often be delayed by a few days, as the banks do not process cheques on weekends or public holidays.For example, if a cheque is deposited on Friday evening, it will likely begin processing on Monday, and the funds may not be available until the following Wednesday or Thursday, depending on the type of cheque.

- Cheque Bounce and Returned Cheques Sometimes, a cheque may not clear at all, which means it has “bounced” or been returned. This can happen if there are insufficient funds in the drawer’s account, a mismatch in signatures, or the cheque is invalid for some other reason. In such cases, the payee will be notified that the cheque has been returned, and they may need to pursue alternative payment options.

- Cheque Clearing Times by Country Different countries have varying timelines for cheque clearing. For example:

- United States: Cheques typically take 2 to 5 business days to clear domestically. For international cheques, this could take longer.

- United Kingdom: In the UK, cheques take around 2 to 5 working days for clearance, with some banks offering faster services.

- India: In India, cheque clearing takes between 2 to 7 business days, depending on whether it is a local or outstation cheque.

Conclusion

The time it takes for a cheque to mature varies based on the type of cheque, the banks involved, the locations of the drawer and payee, and the method of deposit. Generally, personal cheques take 2 to 5 business days to clear, while certified cheques or bank drafts can clear much quicker, sometimes within 1 to 2 days. Factors like weekends, holidays, and discrepancies can further affect this timeline. While digital systems have made the process faster, traditional cheque clearing still takes time, and it is essential to plan your finances accordingly.

Support Our Website!

We appreciate your visit and hope you find our content valuable. If you’d like to support us further, please consider contributing through the TILL NUMBER: 9549825. Your support helps us keep delivering great content!

Thank you for your generosity!

The clarity and insight you offer here have the power to change the way we see the world around us.

Luar biasa dengan konten yang dibagikan, memberikan ide baru.

Saya mendapatkan ide segar dan kemarin juga mampir ke **mocomedecor.com**

yang menampilkan tips desain kreatif dengan gaya sederhana.

Mudah-mudahan makin sukses.