simply amazing, always for you.

Money is one of the biggest sources of conflict in relationships—especially when couples earn very different amounts. Whether you’re dating, cohabiting, or married, navigating finances when one partner earns significantly more than the other can be tricky. But with the right strategy, transparency, and mutual respect, it’s absolutely possible to build a financial life that works for both of you.

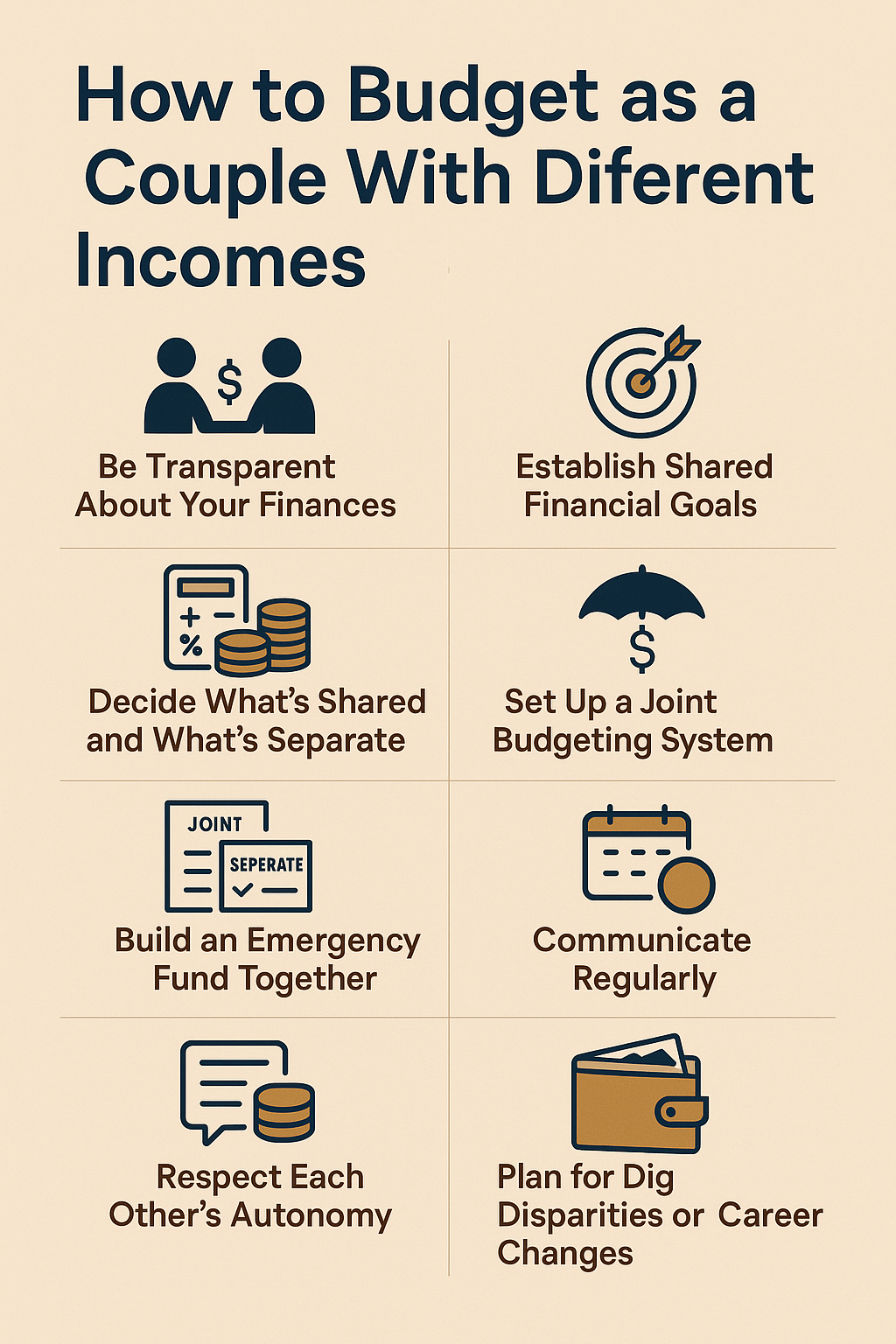

In this comprehensive guide, we’ll break down exactly how to budget as a couple with different incomes. You’ll learn how to talk about money without fighting, design a fair and flexible budget, and reach your financial goals together—no matter who earns more.

Why Unequal Incomes Can Create Tension

Before we dive into strategies, it’s important to understand why differing incomes can cause friction. It’s not just about the numbers—it’s about perception, expectations, and emotions.

Here are a few reasons why income disparities can spark tension:

- Power dynamics: The higher earner may feel entitled to more control over decisions, while the lower earner may feel like they lack autonomy.

- Lifestyle mismatches: One person might afford luxury, while the other has to budget tightly.

- Guilt and resentment: The higher earner may feel burdened; the lower earner may feel guilty or inadequate.

- Unspoken expectations: Each partner may assume different things about who pays for what, leading to confusion and disappointment.

By addressing these dynamics openly and intentionally, you can create a fair, respectful budget that supports both your needs and values.

Step 1: Start With Financial Transparency

You cannot build a budget together if you’re not open about what you’re working with. The first step is a no-judgment financial check-in.

Discuss the following:

- Monthly income (after tax)

- Debts (credit cards, loans, etc.)

- Recurring expenses (subscriptions, bills, rent)

- Financial goals (short- and long-term)

- Spending habits and attitudes toward money

This isn’t just about numbers—it’s about understanding where each person is coming from. Maybe one of you grew up in a frugal household, while the other was used to spending freely. Identifying these money mindsets can help you work better as a team.

Step 2: Define Your Shared Financial Goals

Money without a purpose can easily cause conflict. That’s why it’s crucial to define what you’re working toward as a couple.

Ask each other:

- What are our short-term financial goals? (e.g., saving for a vacation, paying off credit card debt)

- What are our long-term goals? (e.g., buying a home, retirement, starting a business)

- How much do we want to save each month?

- Are we building an emergency fund?

Once you’re aligned on your goals, it becomes easier to make budgeting decisions that support them—even when incomes are unequal.

Step 3: Choose a Fair Contribution Method

This is where most couples get stuck. How do you split bills when one person earns twice as much as the other? A 50/50 split might sound fair on the surface, but it can be unfair in practice.

Here are three popular models:

1. Proportional Contributions (Recommended)

In this model, each partner contributes to shared expenses based on their percentage of total household income.

Example:

- Partner A earns $4,000/month

- Partner B earns $2,000/month

- Combined income: $6,000

Partner A earns 67% and Partner B earns 33%, so they contribute to shared expenses in that proportion.

If rent and bills total $3,000:

- Partner A pays $2,010 (67%)

- Partner B pays $990 (33%)

Pros:

- Feels fair relative to income

- Avoids putting strain on the lower earner

- Maintains balance and respect

Cons:

- Slightly more complex to calculate

- May feel unequal to traditionalists who prefer 50/50

2. Combine All Income and Share Everything

This is ideal for couples who are fully merged financially. You pool all income into a joint account and pay for everything together. Personal spending comes from the joint budget.

Pros:

- Simple and unified

- Encourages a team mentality

- Avoids tracking who owes what

Cons:

- Can cause tension if one partner spends more

- Requires strong communication and shared values

3. Keep Finances Mostly Separate, Split Bills

You split shared expenses either 50/50 or by a pre-agreed method, and keep personal income and spending separate.

Pros:

- High financial autonomy

- Useful early in relationships or second marriages

Cons:

- Can feel transactional

- May lead to inequality over time

Step 4: Identify Shared vs. Individual Expenses

Once you’ve chosen a contribution method, decide which expenses are joint and which are personal.

Shared expenses typically include:

- Rent or mortgage

- Utilities

- Groceries

- Internet

- Car payments (if shared)

- Household repairs

- Childcare or school fees

- Joint travel or entertainment

Personal expenses include:

- Hobbies

- Personal shopping

- Student loan payments

- Gifts for friends/family

- Individual subscriptions (e.g., Spotify, gym)

You can each manage personal expenses from your own account after contributing to the joint fund.

Step 5: Build a Shared Budget System

Now it’s time to create a shared budget to track everything. Whether you prefer spreadsheets or budgeting apps, consistency is key.

Popular budgeting tools for couples:

- YNAB (You Need A Budget) – Great for goal-setting and real-time tracking.

- Honeydue – Made specifically for couples; syncs accounts and tracks shared bills.

- Goodbudget – Envelope-based budgeting for Android and iOS.

- Google Sheets or Excel – Simple, customizable, and free.

Step 6: Create a Joint Emergency Fund

An emergency fund protects both of you in case of job loss, medical expenses, or unexpected bills. Aim to save 3–6 months of shared living expenses.

You can contribute in the same proportion as your incomes or based on what each person can afford. Keep this money in a high-yield savings account that’s easily accessible but separate from your daily spending.

Step 7: Schedule Monthly Money Dates

Talking about money once and forgetting about it is a mistake. Your financial situation—and relationship—will evolve.

Set aside time each month for a money date to:

- Review spending

- Adjust goals

- Check in on savings

- Discuss big upcoming expenses

- Celebrate wins

Keep the tone positive. This isn’t about blame—it’s about building a life together.

Step 8: Respect Financial Independence

Even in committed relationships, personal freedom matters. Having some money each of you can spend freely prevents resentment and the feeling of being micromanaged.

Tips:

- Budget “fun money” for each partner

- Don’t question or criticize how they spend it

- Avoid using income as a tool for control

Mutual respect is more important than who makes more.

Step 9: Plan for Big Life Changes

Income and expenses won’t always stay the same. One of you might go back to school, take time off for caregiving, or pursue a lower-paying dream job.

Be prepared to revisit your budget when:

- A partner loses a job

- You get a raise or promotion

- You move in together or get married

- You have children

- Someone wants to switch careers

Budgeting is a living system—it should grow with you.

Step 10: Don’t Neglect Long-Term Planning

Once your monthly budget is working, zoom out to the bigger picture.

Discuss:

- Retirement savings (e.g., 401(k), IRAs)

- Investments (stocks, real estate)

- Life and disability insurance

- Wills and estate planning

- Future big purchases (home, car, education)

Even if only one of you is actively saving for retirement, the goal should be long-term security for both of you.

Sample Budget for Couples With Different Incomes

Let’s say you’re using the proportional method. Here’s a sample breakdown.

Incomes

- Partner A: $5,000/month

- Partner B: $3,000/month

- Combined: $8,000

Partner A earns 62.5%

Partner B earns 37.5%

Monthly Joint Expenses: $4,000

| Expense | Partner A (62.5%) | Partner B (37.5%) |

|---|---|---|

| Rent: $2,000 | $1,250 | $750 |

| Groceries: $600 | $375 | $225 |

| Utilities: $300 | $187.50 | $112.50 |

| Car: $500 | $312.50 | $187.50 |

| Insurance: $300 | $187.50 | $112.50 |

| Entertainment: $300 | $187.50 | $112.50 |

| Total: | $2,500 | $1,500 |

Each partner handles their own personal expenses with the remaining income.

Budgeting Is About Teamwork, Not Equality

Budgeting as a couple with different incomes doesn’t have to be stressful. The key is creating a system that feels fair, flexible, and aligned with your shared values. Remember:

- Open communication builds trust.

- Fairness matters more than strict equality.

- Your goals should reflect both partners’ priorities.

- Respect each other’s independence and contribution.

Money isn’t just about dollars—it’s about how you treat each other. Done right, your budget becomes a tool for deeper connection, not division.

Support Our Website!

We appreciate your visit and hope you find our content valuable. If you’d like to support us further, please consider contributing through the TILL NUMBER: 9549825. Your support helps us keep delivering great content!

If you’d like to support Nabado from outside Kenya, we invite you to send your contributions through trusted third-party services such as Remitly, SendWave, or WorldRemit. These platforms are reliable and convenient for international money transfers.

Please use the following details when sending your support:

Phone Number: +254701838999

Recipient Name: Peterson Getuma Okemwa

We sincerely appreciate your generosity and support. Thank you for being part of this journey!